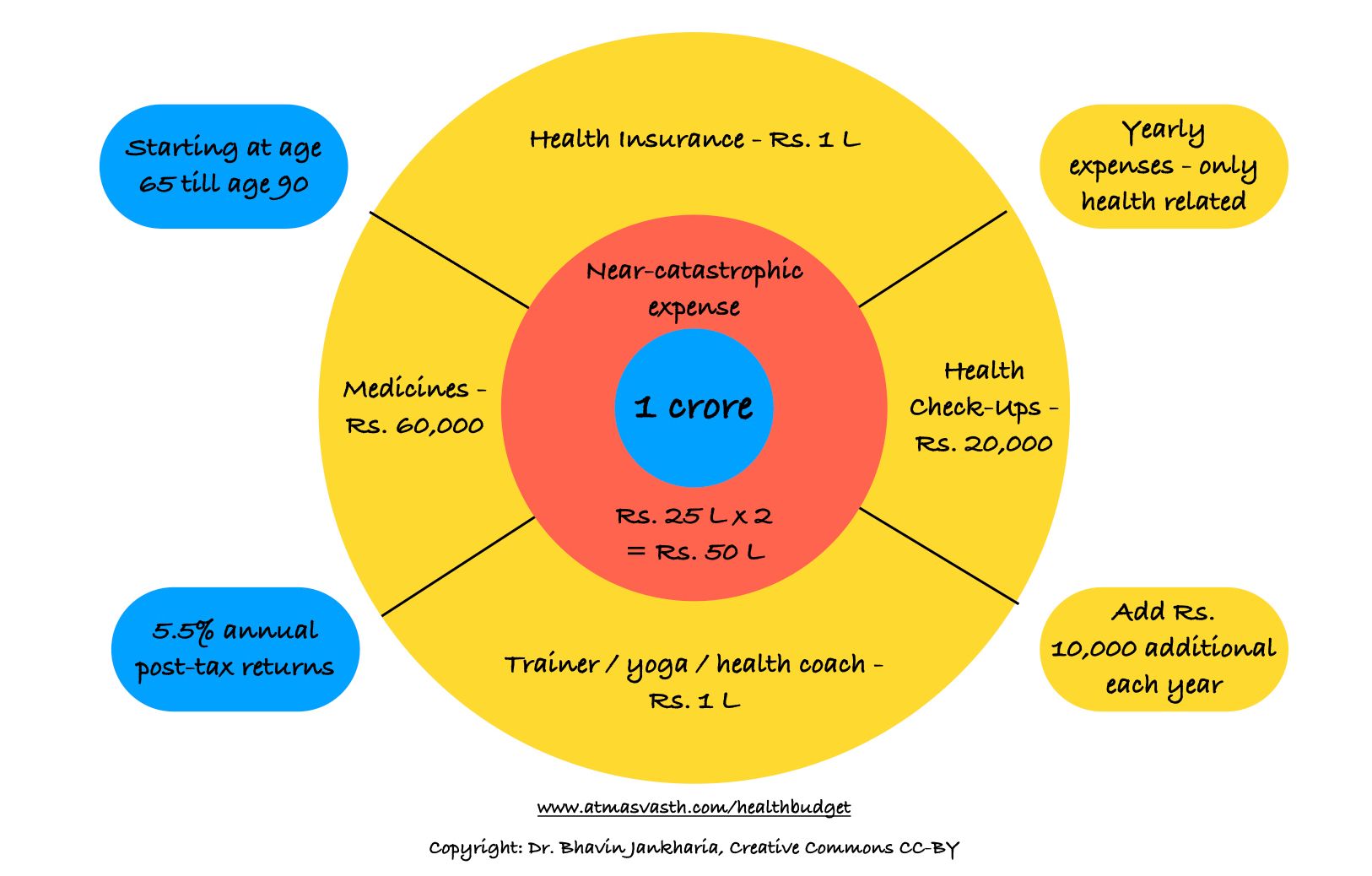

1 Crore - The Investment You Need to Live Long, Healthy in India

1 crore is the average investment you need at age 65 to live long, healthy till age 90/95 in India

With help from Ms. Vidula Warawadekar, economist and Mr. Apurva Shah, author of Finfacts

You can listen to the audio/podcast hosted on Soundcloud by clicking the Play button below within the browser itself. You can click here to access directly from your email.

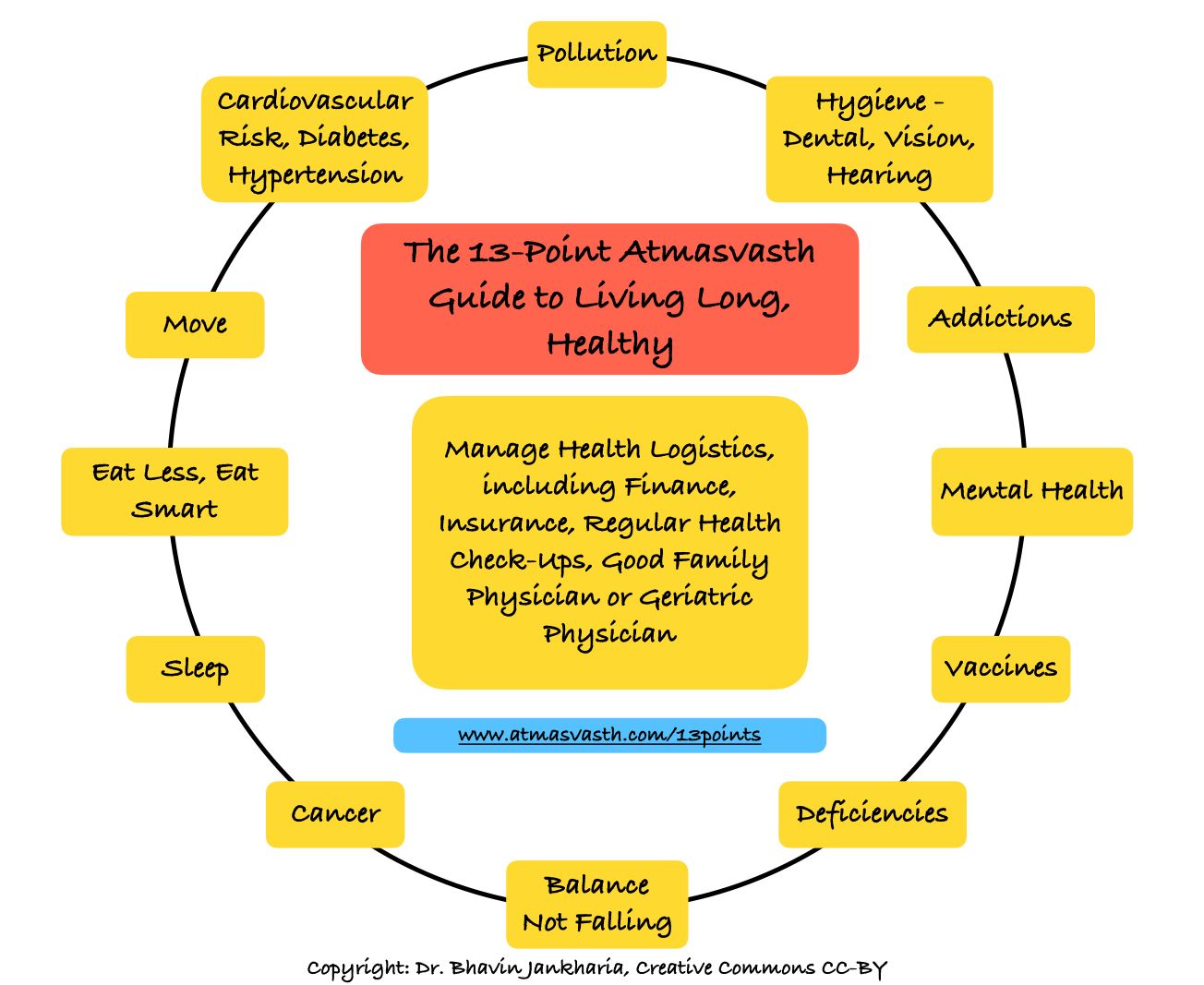

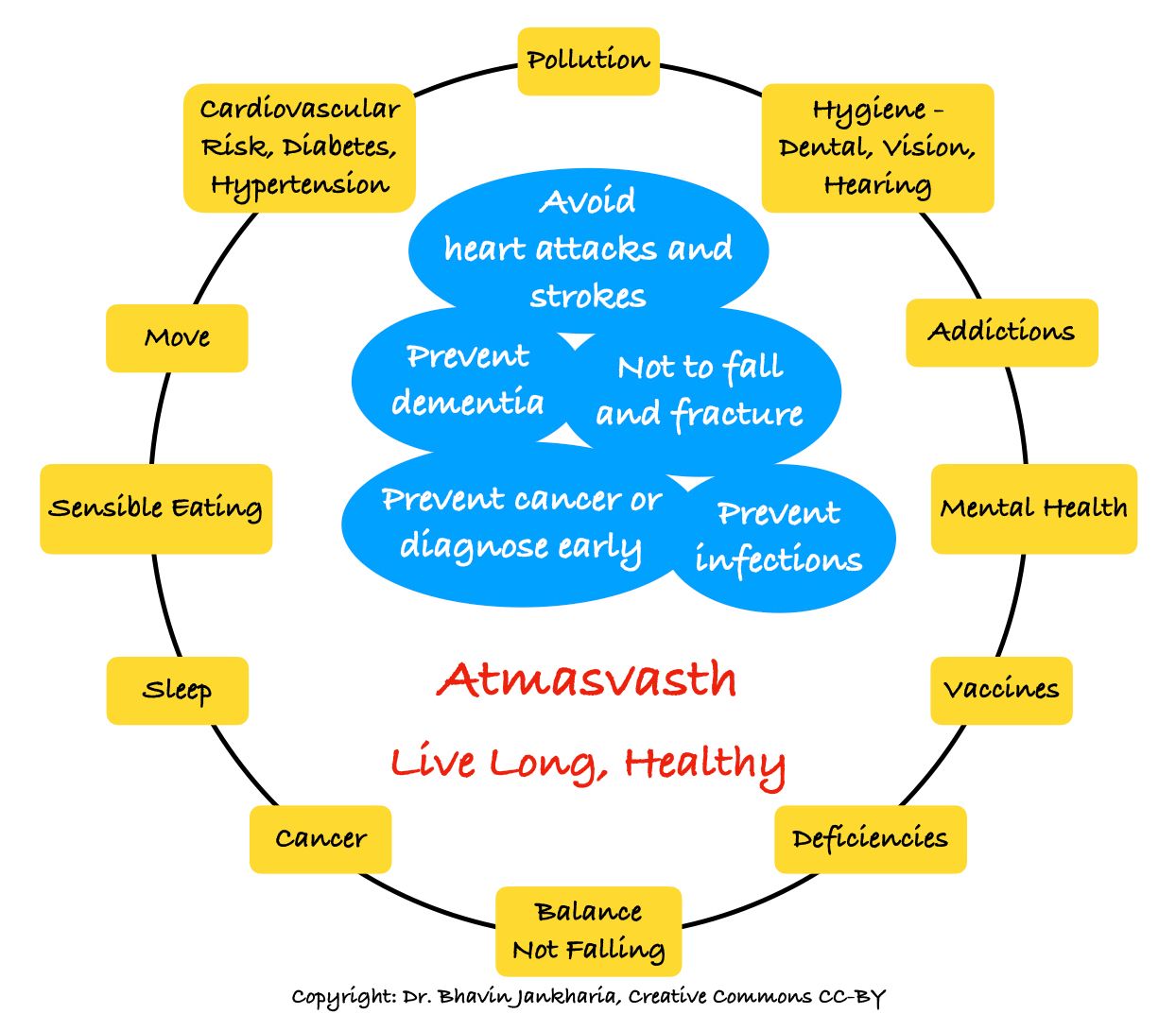

In our atmasvasth quest to live long healthy, we have seen till now how we need to eat smart, be physically active, take our vaccines, screen for disease, manage our cardiovascular risk and so on.

We have also seen how important it is to have active, non-lapsed health insurance. An important part of our atmasvasth quest is being financially independent (atmanirbhar) and having enough money to sustain ourselves till the age of 90, if not longer, without the need to rely on our children or relatives or the system.

I am sure most of you are in the habit of saving and investing an adequate amount so that you have enough money to sustain yourself once you are older and have stopped earning a steady work income. What follows is a blueprint that describes the amount of investment you need by age 65, to live long, healthy up to the age of 90 or 95.

The assumptions are as follows.

1. You do not have a running working income after the age of 65 years.

2. You do not want to be dependent on your children.

3. You may have large, near-catastrophic expenses of up to Rs. 25 L, over and above your health insurance, at least twice in that lifespan.

4. You have active health insurance that has not lapsed.

5. You do not want to use the public health infrastructure of Government and Municipal hospitals.

6. Your non-health expenses on food, clothes, rent, society maintenance, travel, vacations, gifts and gadgets are not part of this calculation.

These are the estimated annual expenses for you and your spouse.

1. Insurance - at least Rs. 1,00,000

2. Medicines - statins, aspirins, supplements, blood pressure and diabetes medicines - Rs. 60,000

3. Health check-ups - Rs. 20,000

4. Trainer / yoga teacher / meditation guide / health coach - Rs.1,00,000

5. Near-catastrophic illness buffer - at least two episodes in 25 years - Rs 50 lakhs

6. Rs. 10,000 compounded added per year to this number.

The average expense therefore, starting at age 65, comes to Rs. 2.8 lakhs per year (Rs. 24,000 per month), to which you have to add another Rs. 10,000 per year compounded till age 90 or 95.

To generate this income (I repeat, this is over and above what you need for food, clothes, rent, society maintenance, travel, vacations, gadgets), means an investment of approximately Rs. 1.0 crore, earning a post-tax 5.5% interest. At age 90, you may still have around Rs. 30-40 L left over, but if you live the same way till age 95 or 100, you will likely run out of this money.

If you reduce your expenses, let’s say by cutting out the trainer/yoga/health coach, you will still need Rs. 1.8 L per year, increasing by Rs. 10,000 each year, in which case with an investment of Rs. 75 L, earning 5.5% post-tax return, you would be left with around Rs. 25-33 L at age 90 and Rs. 0-10 L at age 95.

The longer you live, the more money you will need to sustain your life. Most of us tend to underestimate this amount and undersave and/or underbudget. If your investments give you better returns or if you don’t have near-catastrophic one-time expenses, or if your medicines cost less, you will need less than 1 crore. But on the other hand, if your returns dip or if you have higher expenses, you may need to have started with a larger investment amount.

In this scenario, if you do not have health insurance, you are very likely to be screwed in today’s day and age, unless you are very, very lucky, or very, very rich, or surrounded by very loving children and grand-children who take care of you and your health expenses.

Hence, to be financially atmanirbhar in our atmasvasth quest, Rs. 75 L to 1 crore is the average investment you need at age 65, to live long, healthy till age 90/95, in a low and middle income country like India, as a member of the middle class and higher, without help and support from your children and other family members, assuming an active health insurance plan, without being dependent on the public health infrastructure, over and above what you need for the rest of your living expenses (rental, society maintenance, food, clothing, travel, gifts, etc).

Footnotes:

1 crore is 10 million rupees or around 135,000 USD

1 lakh is 100,000 rupees or 1,350 USD

2.8 lakhs is 280,000 rupees or 3800 USD

1.8 lakhs is 180,000 rupees or 2440 USD

Last Wednesday's Post

Last Sunday's Post

Essential Reading

Please see the Archives for the rest of the posts.

Atmasvasth Newsletter

Join the newsletter to receive the latest updates in your inbox.